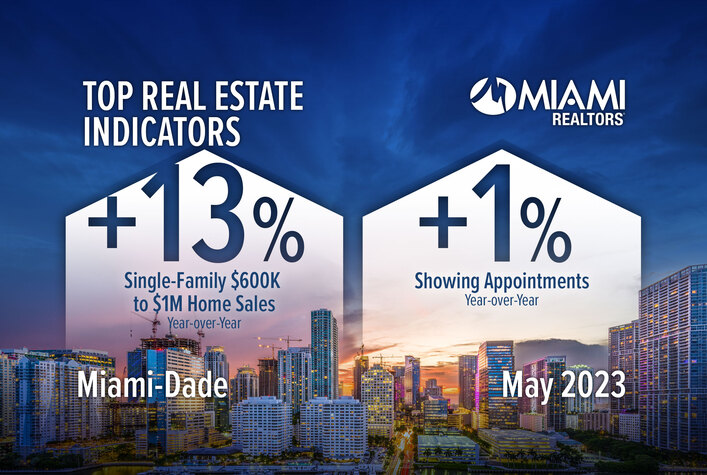

Miami-Dade Single-Family $600K to $1M Home Sales Rise; South Florida Showing Appointments Increase Year-over-Year

Link: https://www.miamirealtors.com/2023/06/22/miami-dade-single-family-600k-to-1m-home-sales-rise-south-florida-showing-appointments-increase-year-over-year/

Courtesy MiamiRealtors.com

MIAMI — Miami-Dade County single-family $600,000 to $1M home sales surged while South Florida showing appointments also rose year-over-year, according to May 2023 statistics released by the MIAMI Association of Realtors (MIAMI) and the Multiple Listing Service (MLS) system.

Miami-Dade single-family $600,000 to $1M home sales surged 12.9% year-over-year in May 2023, increasing to 342 transactions. South Florida showing appointments, meanwhile, increased 1%, from 245,225 in May 2022 to 248,540 in May 2023.

“The rise in showing appointments is an important leading indicator for future South Florida real estate sales,” MIAMI Chairman Ines Hegedus Garcia said. “The foot traffic is there; we just need more inventory particularly in certain price points. Supply is increasing each month and we are beginning to see a normalizing market, which will translate to flexibility from sellers and more equitable contract terms that favor both sides.”

Percentage of Miami-Dade Cash Sales Rise as Mortgage Rates Stay in 6-7% Range

About 40.9% of all Miami-Dade existing purchases were made in cash in May 2023, an increase from 37.9% in April 2023. Cash buyers are not deterred by rising rates. In May 2023, cash sales accounted for 53.4% of all Miami existing condo sales and 24.3% of single-family transactions.

Miami total home sales decreased 24.6% year-over-year in May 2023, from a historic 3,198 transactions in May 2022 to 2,412 in May 2023, because of elevated mortgage rates and lack of supply in certain price points.

Most of the homes purchased in May 2023 came to terms in April when mortgage rates averaged around 6.28%. Rates, in comparison, were at 5.27% on May 5, 2022.

Home sales are sensitive to mortgage rate changes. According to Freddie Mac, the 30-year fixed-rate mortgage 6.69% as of June 15. That’s down from 6.71% the previous week but up from 5.78% one year ago.

“With the Fed holding off on its rate increases briefly, I expect a busier summer market as interest rate-sensitive buyers take advantage of low mortgage rates– likely climbing down to the low 6% through September,” MIAMI REALTORS® Chief Economist Gay Cororaton said.

Miami single-family home sales decreased 12.8% year-over-year, from 1,193 in May 2022 to 1,040 in May 2023 because of its comparison to a historic month and the current market has lower inventory in specific price points and higher rates.

Miami existing condo sales decreased 31.6% year-over-year, from a historic 2,005 in May 2022 to 1,372 in May 2023, due to lack of inventory and rising mortgage rates.

Miami Home Prices, Household Income Rise with Wealth Migration

Miami-Dade County single-family home median prices increased 7.8% year-over-year in May 2023, increasing from $575,000 to $620,000. Miami single-family median prices have risen for 138 consecutive months (11.5 years), the longest running-streak on record. Existing condo median prices stayed even year-over-year at $415,000. Condo median prices have stayed even or increased in 138 of the last 144 months.

In-migration boosted South Florida household income by $16 Billion in 2021, according to MIAMI REALTORS® analysis of the 2020-2021 migration data released by the Internal Revenue Service.

New households moving into Miami-Dade in 2021 had an average adjusted gross income of $229,300. New households moving into Broward County had an average adjusted gross income of $102,600. New households moving into Palm Beach County had an average adjusted gross income of $242,200.

About 45,430 people moved into Miami-Dade in 2021, up 15% from the level in 2020 (39,562) and up 20% from the level in 2019 (37,630). Top households that moved into Miami-Dade included Kings County, New York; Cook County, Illinois; Queens County, New York; and Harris County, Texas.

Home prices are determined by supply and demand. Lower supply and higher demand create higher prices. Inventory for Miami single-family homes (3.3 months) and condos (5.1 months) are low. Also, one of the supports for home prices is rents and rents are up.

Miami-Dade Inventory, New Listings Near All-Time Lows

While inventory is rising, Miami-Dade inventory is still near all-time lows. The monthly historical average for Miami-Dade inventory is 20,302 and current inventory is at 9,331. Total inventory is down 58.9% from pre-pandemic (May 2019), from 22,707 to 9,331.

Total active listings at the end of May increased 19.4% year-over-year, from 7,814 to 9,331.

Inventory of single-family homes increased 8.2% year-over-year in May 2023 from 2,790 active listings last year to 3,018 last month. Condominium inventory increased 25.7% year-over-year to 6,313 from 5,024 listings during the same period in 2022.

New listings of Miami single-family homes decreased 26.3% to 1,336 from 1,813 year-over-year. New listings of condominiums decreased 23.6%, from 2,521 to 1,925 year-over-year.

Months’ supply of inventory for single-family homes increased 50% to 3.3 months year-over-year, which indicates a seller’s market. Inventory for existing condominiums increased 104% to 5.1 months, which also indicates a seller’s market. A balanced market between buyers and sellers offers between six- and nine-months supply.

Nationally, total housing inventory at the end of May was 1.08 million units, up 3.8% from April but down 6.1% from one year ago (1.15 million). Unsold inventory sits at a 3.0-month supply at the current sales pace, up from 2.9 months in April and 2.6 months in May 2022.

Miami Real Estate Posts $294.3 Million Local Economic Impact in May 2023

Every time a home is sold it impacts the economy: income generated from real estate industries (commissions, fees and moving expenses), expenditures related to home purchase (furniture and remodeling expenses), multiplier of housing related expenditures (income earned as a result of a home sale is re-circulated into the economy) and new construction (additional home sales induce added home production).

The total economic impact of a typical Florida home sale is $122,000, according to NAR. Miami-Dade sold 2,412 homes in May 2023 and had a local economic impact of $294.3 million.

Miami total dollar volume totaled $2.1 billion in May 2023. Single-family home dollar volume decreased 17.22% year-over-year to $1.1 billion. Condo dollar volume decreased 35.18% year-over-year to $983 million.

Miami Distressed Sales Remain Low, Reflecting Healthy Market

Only 1.1% of all closed residential sales in Miami were distressed last month, including REO (bank-owned properties) and short sales, lower than 1.2% in May 2022. In 2009, distressed sales comprised 70% of Miami sales.

Short sales and REOs accounted for 0.2% and 0.9% year-over-year, respectively, of total Miami sales in May 2023.

Miami’s percentage of distressed sales are on par with the national figure. Nationally, distressed sales represented 2% of sales in May, virtually unchanged from last month and the prior year.

Miami Median Price Appreciation Outperforming Nation, State

In Florida, closed sales of single-family homes statewide totaled 26,396 in May 2023, down 8.5% year-over-year, while existing condo-townhouse sales totaled 11,392, down 14.1%. Closed sales may occur from 30- to 90-plus days after sales contracts are written.

Nationally, total existing-home sales transactions rose 0.2% from April to a seasonally adjusted annual rate of 4.30 million in May. Year-over-year, sales dropped 20.4% (down from 5.40 million in May 2022).

The statewide median sales price for single-family existing homes was $419,900, down from 420,000 the previous year, according to data from Florida Realtors Research Department in partnership with local Realtor boards/associations. Last month’s statewide median price for condo-townhouse units was $325,000, up 0.9% over the year-ago figure. The median is the midpoint; half the homes sold for more, half for less.

Nationally, the median existing-home price for housing types in May was $396,100, a decline of 3.1% from May 2022 ($408,600). Prices grew in the Northeast and Midwest but fell in the South and West.

Miami Real Estate Attracting Near List Price

The median percent of original list price received for single-family homes was 96.8% in May 2023, down from 100% last year. The median percent of original list price received for existing condominiums was 96.3%, down from 100% last year.

The median number of days between listing and contract dates for Miami single-family home sales was 27 days, up from 14 days last year. The median time to sale for single-family homes was 71 days, up from 58 days last year.

The median number of days between the listing date and contract date for condos was 36 days, up from 21 days. The median number of days to sale for condos was 77 days, down from 67 days.

Miami Cash Sales 63.6% More than National Figure

Cash sales represented 40.9% of Miami closed sales in May 2023, compared to 44.4% in May 2022. About 25% of U.S. home sales are made in cash, according to the latest NAR statistics.

Cash buyers are not deterred by rising rates. The high percentage of cash buyers reflects Miami’s top position as the preeminent American real estate market for foreign buyers, who tend to purchase with all cash as well as some moving from more expensive U.S. markets who can buy more with their profits from real estate sales.

Cash sales accounted for 53.4% of all Miami existing condo sales and 24.3% of single-family transactions.

For breaking news on the Miami Real Estate Market please subscribe to:

~ Maji’s Market Minute Blog on MiamiHomeTrends.com http://bit.ly/

~ Maji’s Market Minute YouTube channel: https://bit.ly/

When experience matters, work with Maji for all your real estate needs.

• Second-generation Realtor

• Miami Real Estate Market expert

• Miami native

#majiramosrealestateadvisorpa #miami_home_trends #majismarketminute #majigreeninitiative #majisold #majipaceramos #miamirealtor #miamirealestate #miamirealestategent #majiramos #Miamirealetstatemarket #homesellinginmiami #miamilistingagent #miamihomesforsale #miamicondosforsale #priceyourhouseright #homevaluation #zillow #zestimate #homecalculator #whatsmyhomeworth #hasmyhomegonedowninvalue #miamihometrends #movingtomiami #miamineighborhoods #googlemaji #realestatemarket #singlefamilyhome #miamidade #singlefamilyhomesmiami #MiamiRealtors

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link