Published by Maji Pace Ramos on June 20, 2023

Today’s mortgage rates are top-of-mind for many homebuyers right now. As a result, if you’re thinking about buying for the first time or selling your current house to move into a home that better fits your needs, you may be asking yourself these two questions:

1. Why Are Mortgage Rates So High?

2. When Will Rates Go Back Down?

Here’s the context you need to help answer those questions.

1. Why Are Mortgage Rates So High?

The 30-year fixed-rate mortgage is largely influenced by the supply and demand for mortgage-backed securities (MBS). According to Investopedia:

“Mortgage-backed securities (MBS) are investment products similar to bonds. Each MBS consists of a bundle of home loans and other real estate debt bought from the banks that issued them . . . The investor who buys mortgage-backed security is essentially lending money to home buyers.”

Demand for MBS helps determine the spread between the 10-Year Treasury Yield and the 30-year fixed mortgage rate. Historically, the average spread between the two is 1.72 (see chart below):

Last Friday morning, the mortgage rate was 6.85%. That means the spread was 3.2%, which is almost 1.5% over the norm. If the spread was at its historical average, mortgage rates would be 5.37% (3.65% 10-Year Treasury Yield + 1.72 spread).

This large spread is very unusual. As George Ratiu, Chief Economist at Keeping Current Matters (KCM), explains:

“The only times the spread approached or exceeded 300 basis points were during periods of high inflation or economic volatility, like those seen in the early 1980s or the Great Financial Crisis of 2008-09.”

The graph shows how the spread has come down after each peak. The good news is, that means there’s room for mortgage rates to improve today.

For breaking news on the Miami Real Estate Market please subscribe to:

~ Maji’s Market Minute Blog on MiamiHomeTrends.com http://bit.ly/

~ Maji’s Market Minute YouTube channel: https://bit.ly/

So, what’s causing the larger spread and making mortgage rates so high today?The demand for MBS is heavily influenced by the risks associated with investing in them. Today, that risk is impacted by broader market conditions like inflation and fear of a potential recession, the Fed’s interest rate hikes to try to bring down inflation, headlines that create unnecessarily negative narratives about home prices, and more.

Simply put: when there’s less risk, demand for MBS is high, so mortgage rates will be lower. On the other hand, if there’s more risk with MBS, demand for MBS will be low, and we’ll see higher mortgage rates as a result. Currently, demand for MBS is low, so mortgage rates are high.

2. When Will Rates Go Back Down?

Odeta Kushi, Deputy Chief Economist at First American, answers that question in a recent blog:

“It’s reasonable to assume that the spread and, therefore, mortgage rates will retreat in the second half of the year if the Fed takes its foot off the monetary tightening pedal and provides investors with more certainty. However, it’s unlikely that the spread will return to its historical average of 170 basis points, as some risks are here to stay.”

Bottom Line

The spread will shrink when the fear investors feel is eased. That’ll mean we should see mortgage rates moderate as the year goes on. However, when it comes to forecasting mortgage rates, no one can know for sure exactly what will happen.

#majiramos #Miamirealetstatemarket #homesellinginmiami #miamilistingagent #miamihomesforsale #miamicondosforsale #priceyourhouseright

#homevaluation #zillow #zestimate #homecalculator #whatsmyhomeworth #hasmyhomegonedowninvalue #miamihometrends #movingtomiami #miamineighborhoods

#googlemaji #realestatemarket #rentvsbuy #homeownershipmatters #investinyourfuture #makthebestdecision

❤🖤💚❤🖤💚❤🖤💚

Published by Maji Pace Ramos on June 16, 2023

You may see media coverage talking about a drop in homeowner equity. What’s important to understand is that equity is tied closely to home values. So, when home prices appreciate, you can expect equity to grow. And when home prices decline, equity does too. Here’s how this has played out recently.

Home prices rose rapidly during the ‘unicorn’ years. That gave homeowners a considerable equity boost. But those ‘unicorn’ years couldn’t last forever. The market had to moderate at some point, and that’s what we saw last fall and winter.

As home prices dropped slightly in the back half of 2022, equity was impacted. Based on the most recent report from CoreLogic, there was a 0.7% dip in homeowner equity over the last year. However, the headlines reporting on that change aren’t painting the whole picture. The reality is, while home price depreciation during the second half of last year caused equity to drop, the data shows homeowners still have near-record amounts of equity.

The graph below helps illustrate this point by looking at the total amount of tappable equity in this country going all the way back to 2005. Tappable equity is the amount of equity available for homeowners to access before hitting a maximum 80% loan-to-value ratio (LTV). As the data shows, there was a significant equity boost during the ‘unicorn’ years as home prices rapidly appreciated (see the pink in the graph below).

But here’s what’s key to realize – even though there’s been a small dip, total homeowner equity is still much higher than it was before the ‘unicorn’ years.

And there’s more good news. Recent home price reports show the worst home price declines are behind us, and prices have started to go up again. As Selma Hepp, Chief Economist at CoreLogic, explains:

“Home equity trends closely follow home price changes. As a result, while the average amount of equity declined from a year ago, it increased from the fourth quarter of 2022, as monthly home prices growth accelerated in early 2023.”

The last part of that quote is particularly important and is the piece of the puzzle the news is leaving out. To further emphasize the positive turn we’re already seeing, experts say home prices are forecast to appreciate at a more normal rate over the next year. In the same report, Hepp puts it this way:“The average U.S. homeowner now has more than $274,000 in equity – up significantly from $182,000 before the pandemic. Also, while homeowners in some areas of the country who bought a property last spring have no equity as a result of price losses, forecasted home price appreciation over the next year should help many borrowers regain some of that lost equity.”

And even though Odeta Kushi, Deputy Chief Economist at First American, references a slightly different number, Kushi further validates the fact that homeowners have a lot of equity right now:“Homeowners today have an average of $302,000 in equity in their homes.”

Context is everything when looking at headlines. While homeowner equity dropped some from last year, it’s still near all-time highs. Let’s connect so you can get the answers you deserve from an expert who’s here to help as you plan your move this year.

#majiramos #Miamirealetstatemarket #homesellinginmiami #miamilistingagent #miamihomesforsale #miamicondosforsale #priceyourhouseright

#homevaluation #zillow #zestimate #homecalculator #whatsmyhomeworth #hasmyhomegonedowninvalue #miamihometrends #movingtomiami #miamineighborhoods

#googlemaji #homeownerequity #homevalueappreciation #equitygrowth #realestatemarket #tappableequity #unicornyears #positiveturn #forecastedappreciation #contextmatters #expertadvice

Media coverage about what’s happening with home prices can be confusing. A large part of that is due to the type of data being used and what they’re choosing to draw attention to. For home prices, there are two different methods used to compare home ![]() prices over different time periods: year-over-year (Y-O-Y) and month-over-month (M-O-M). Here’s an explanation of each.

prices over different time periods: year-over-year (Y-O-Y) and month-over-month (M-O-M). Here’s an explanation of each.

Year-over-Year (Y-O-Y): ![]()

This comparison measures the change in home prices from the same month or quarter in the previous year. For example, if you’re comparing Y-O-Y home prices for April 2023, you would compare them to the home prices for April 2022.

This comparison measures the change in home prices from one month to the next. For instance, if you’re comparing M-O-M home prices for April 2023, you would compare them to the home prices for March 2023.

We’re about to enter a few months when home prices could possibly be lower than they were the same month last year. April, May, and June of 2022 were three of the best months for home prices in the history of the American housing market. Those same months this year might not measure up. That means the Y-O-Y comparison will probably show values are depreciating. The numbers for April seem to suggest that’s what we’ll see in the months ahead (see graph below):

However, on a closer look at M-O-M home prices, we can see prices have actually been appreciating for the last several months. Those M-O-M numbers more accurately reflect what’s truly happening with home values: after several months of depreciation, it appears we’ve hit bottom and is bouncing back.

Here’s an example of M-O-M home price movements for the last 16 months from the CoreLogic Home Price Insights report (see graph below):

So, if you’re hearing negative headlines about home prices, remember they may not be painting the full picture. For the next few months, we’ll be comparing prices to last year’s record peak, and that may make the Y-O-Y comparison feel more negative. But, if we look at the more immediate, M-O-M trends, we can see home prices are actually on the way back up.There’s an advantage to buying a home now. You’ll buy at a discount from last year’s price before prices start to pick up even more momentum. It’s called “buying at the bottom,” and that’s a good thing.Bottom Line

If you have questions about what’s happening with home prices, or if you’re ready to buy before prices climb higher, let’s connect.

#majiramos #Miamirealetstatemarket #homesellinginmiami #miamilistingagent #miamihomesforsale #miamicondosforsale #priceyourhouseright

#homevaluation #zillow #zestimate #homecalculator #whatsmyhomeworth #hasmyhomegonedowninvalue #miamihometrends #movingtomiami #miamineighborhoods

#googlemaji #

#buyatthebottom #fullpicture #connectforexpertadvice #markettrends

Published by Maji Pace Ramos on June 13, 2023

You may have seen reports in the news recently saying it’s better to rent right now than it is to own your home. But before you let that impact your decisions, you should understand what these claims are based on.

A lot of the time, these reports are assuming things that aren’t realistic for the average household. For example, the methodology behind one of those reports says that renting is the smarter financial option because of the opportunity to invest money elsewhere. It assumes renters take the money they’d spend on costs tied to buying a home and put it in an investment portfolio.

But here’s the thing – most people who rent aren’t making those investments. Ken Johnson, Co-Author of the BH&J National Price-to-Rent Index, explains:

“One of the difficulties with the rent and reinvest model is many people . . . simply rent and spend the difference. . . . That’s wealth destroying.”

So, before you renew your rental agreement, think about the opportunity to build wealth that homeownership provides.

Bottom Line

If you’re unsure whether to continue renting or to buy a home, let’s connect to help you make the best decision.

#majiramos #Miamirealetstatemarket #homesellinginmiami #miamilistingagent #miamihomesforsale #miamicondosforsale #priceyourhouseright

#homevaluation #zillow #zestimate #homecalculator #whatsmyhomeworth #hasmyhomegonedowninvalue #miamihometrends #movingtomiami #miamineighborhoods

#googlemaji #realestatemarket #rentvsbuy #homeownershipmatters #investinyourfuture #makthebestdecision

When you look at the numbers today, the one thing that stands out is the strength of this housing market. We can see this is one of the most foundationally strong housing markets of our lifetime – if not the strongest housing market of our lifetime. Here are two fundamentals that prove this point.

1. The Current Mortgage Rate on Existing Mortgages

First, let’s look at the current rate on existing mortgages. According to the Federal Housing Finance Agency (FHFA), as of the fourth quarter of last year, over 80% of existing mortgages have a rate below 5%. That’s significant. And, to take that one step further, over 50% of mortgages have a rate below 4% (see graph below):

Now, there’s a lot of talk in the media about a potential foreclosure crisis or a rise of homeowners defaulting on their loans, but consider this. Homeowners with such good mortgage rates are going to work as hard as they can to keep that mortgage and stay in their homes. That’s because they can’t go out and buy another house, or even rent an apartment, and pay what they do today. Their current mortgage payment is more affordable. Even if they downsize, with today’s higher mortgage rates, it could cost more.

Here’s why this gives the housing market such a solid foundation today. Having so many homeowners with such low mortgage rates helps us avoid a crisis with a flood of foreclosures coming to market like there was back in 2008.

2. The Amount of Homeowner Equity

Second, Americans are sitting on tremendous equity right now. According to the Census and ATTOM, roughly two-thirds (around 68%) of homeowners have either paid off their mortgage or have at least 50% equity (see chart below):

In the industry, the term for this is equity rich. This is significant because if you think back to 2008, some people had to make the difficult decision to walk away from their homes because they owed more on the home than it was worth.

But this time, things are different because homeowners have built up so much equity over the past few years alone. And, when homeowners have that much equity, it helps us avoid another wave of distressed properties coming onto the market like we saw during the crash. It also creates an extremely strong foundation for today’s housing market.

Bottom Line

We are in one of the most foundationally strong housing markets of our lifetime because homeowners are going to fight to keep their current mortgage rate and they have a tremendous amount of equity. This is yet another reason things are fundamentally different than in 2008.

#majiramos #Miamirealetstatemarket #homesellinginmiami #miamilistingagent #miamihomesforsale #miamicondosforsale #priceyourhouseright

#homevaluation #zillow #zestimate #homecalculator #whatsmyhomeworth #hasmyhomegonedowninvalue #miamihometrends #movingtomiami #miamineighborhoods

#googlemaji #realestatemarket

(via FB/Conservation International)

Full article at: https://lnkd.in/eG4QCXaG

What a difference a day makes, look at this weather! Two days ago it was raining with hail.

Did you know that it’s the best time to look at a property ![]() during a torrential rainstorm? This is when you can actually see flood patterns and drainage, and if you can get inside the property, you can see if there are any active leaks.

during a torrential rainstorm? This is when you can actually see flood patterns and drainage, and if you can get inside the property, you can see if there are any active leaks.

I personally love looking at properties during a rainstorm. I actually did this on Tuesday during the storm to look at a building I am considering purchasing as an investment and I wanted to see how the flood patterns were after hours of torrential rain.

#majiramos #Miamirealetstatemarket #homesellinginmiami #miamilistingagent #miamihomesforsale #miamicondosforsale #priceyourhouseright

#homevaluation #zillow #zestimate #homecalculator #whatsmyhomeworth #hasmyhomegonedowninvalue #miamihometrends #movingtomiami #miamineighborhoods

#googlemaji #besttimetobuy #buyerstips #floodinginmiami #homeinspectionsmiami #homeownersinsurance

https://www.iseechange.org/

on ISeeChange.

Report Flooding

“Flooding again on Lucaya St. in Coconut Grove after about 10m of heavy rain.”

– David C.

ISeeChange is proud to serve as the flood reporting tool for the City of Miami. This year, ISeeChange and Miami-Dade County have launched a new partnership to track and understand resident flood experiences. Additionally, we’re taking a closer look at urban heat, tree planting priorities, and pollution in certain areas of the County.

Help us understand how these issues are impacting your community. Every story you share counts, and helps us know where to focus efforts to make our community better.

Make sure you are logged in to the ISeeChange mobile app (and turn on push notifications!) to receive real-time flood alerts for the Miami area this season.

We’ll only send you a text if flooding is confirmed:

ISC on iPhone

ISC on Android

Stay safe, Miami!

Facebook Twitter Instagram

If you’d like to unsubscribe and stop receiving these emails click here .

#ISEECHANGE #flooding #reportflooding #majigreeninitiative #googlemaji

https://www.iseechange.org/

If you’re thinking about retirement or have already retired this year, you may be planning your next steps. One of your goals could be selling your house and finding a home that more closely fits your needs.

Fortunately, you may be in a better position to make a move than you realize. Here are a few things to think about when making that decision.

Consider How Long You’ve Been in Your Home

From 1985 to 2008, the average length of time homeowners typically stayed in their homes was only six years. But according to the National Association of Realtors (NAR), that number is rising today, meaning many homeowners are living in their houses even longer (see graph below):

When you live in a home for a significant period of time, it’s natural for you to experience a number of changes in your life while you’re in that house. As that life changes and milestones happen, your needs may change. And if your current home no longer meets them, you may have better options waiting for you.

Consider the Equity You’ve Gained

Additionally, if you’ve been in your home for more than a few years, you’ve likely built up significant equity that can fuel your next move. That’s because the longer you’ve been in your home, the more likely it’s grown in value due to home price appreciation. Data from the Federal Housing Finance Agency (FHFA) illustrates that point (see graph below):

While home price growth varies by state and local area, the national average shows the typical homeowner who’s been in their house for five years saw it increase in value by over 50%. And the average homeowner who’s owned their home for 30 years saw it almost triple in value over that time.

Consider Your Retirement Goals

Whether you’re looking to downsize, relocate to a dream destination, or move so you live closer to loved ones, that equity can help you achieve your homeownership goals. NAR shares that for recent home sellers, the primary reason to move was to be closer to loved ones. Plus, retirement played a large role for those moving greater distances.

Whatever your home goals are, a trusted real estate advisor can work with you to find the best option. They’ll help you sell your current house and guide you as you buy the home that’s right for you and your lifestyle today.

Bottom Line

Retirement can bring about major changes in your life, including what you need from your home. Let’s connect to explore your opportunities in our local market.

Like “Majic” I’ll get it CLOSED!

(Maji) Maria Ramos Real Estate Advisor P.A

305-519-7940 | maji@majisold.com

Coldwell Banker Realty

• Miami Realtor since 1993

• 2nd Generation Realtor

• Expert Negotiator

• Market Trends Expert

• Miami native

• Bilingual – English & Spanish

• About me: https://linktr.ee/majisold

For the latest breaking news for the Miami Real Estate Market please subscribe to my blog or YouTube channel:

~ Maji’s Market Minute Blog on MiamiHomeTrends.com http://bit.ly/

~ YouTube channel: https://bit.ly/

#majiramosrealestateadvisorpa #miami_home_trends #majismarketminute

#majisold #majipaceramos #miamirealtor #miamirealestate #miamirealestategent

#majiramos #Miamirealetstatemarket #homesellinginmiami #miamilistingagent #miamihomesforsale #miamicondosforsale #priceyourhouseright

#homevaluation #zillow #zestimate #homecalculator #whatsmyhomeworth #hasmyhomegonedowninvalue #miamihometrends #movingtomiami #miamineighborhoods

#googlemaji

#nextchapterhome #homeownershipjourney

Published by Maji Pace Ramos on June 2, 2023

There are many people thinking about buying a home, but with everything affecting the economy, some are wondering if it’s a smart decision to buy now or if it makes more sense to wait it out. As Bob Broeksmit, President and CEO of the Mortgage Bankers Association (MBA), explains:

“The desire for homeownership is strong. Many prospective buyers are waiting for the volatility in mortgage rates to subside, as well as for a clearer picture of the economic outlook.”

If you’re in that position, remember that it’s important to consider not just what’s happening today but also what benefits you may gain in the long run.

There’s a lot of information out there about how homeownership helps build a homeowner’s net worth over time. But even today, many people think first about things like 401(k)s before they think of owning a home as a wealth-building tool. It’s especially important if you’re a young prospective homebuyer to understand how homeownership is another key way to invest in your future. An article from Bloomberg notes:

“Millennials have higher average 401(k) balances than Generation X did when they were the same age, but they’re not any better off financially. . . . A lot of that has to do with being less likely to own a home.”

To help you understand just how much owning a home can have a positive impact on your life over the years, take a look at what the data shows. The same Bloomberg article helps show the gap in wealth between renters and homeowners who are 65 years and older (see graph below). The difference is substantial, even when incomes are similar.

So, if you want to create wealth to help set you up for success later on, it may be time to prioritize homeownership. That’s because, whether you decide to rent or buy a home, you’ll have a monthly housing expense either way. The question is: are you going to invest in yourself and your future, or will you help someone else (your landlord) increase their wealth?

Bottom Line

Before putting your homeownership plans on hold, let’s connect to go over your options. That way, you’ll have expert advice on how to make the best decision right now and the best investment in your future.

Like “Majic” I’ll get it CLOSED!

(Maji) Maria Ramos Real Estate Advisor P.A

305-519-7940 | maji@majisold.com

Coldwell Banker Realty

• Miami Realtor since 1993

• 2nd Generation Realtor

• Expert Negotiator

• Market Trends Expert

• Miami native

• Bilingual – English & Spanish

• About me: https://linktr.ee/majisold

For the latest breaking news for the Miami Real Estate Market please subscribe to my blog or YouTube channel:

~ Maji’s Market Minute Blog on MiamiHomeTrends.com http://bit.ly/

~ YouTube channel: https://bit.ly/

#investinyourfuture #wealthbuilding

#majiramosrealestateadvisorpa #miami_home_trends #majismarketminute

#majisold #majipaceramos #miamirealtor #miamirealestate #miamirealestategent

#majiramos #Miamirealetstatemarket #homesellinginmiami #miamilistingagent #miamihomesforsale #miamicondosforsale #priceyourhouseright

#homevaluation #zillow #zestimate #homecalculator #whatsmyhomeworth #hasmyhomegonedowninvalue #miamihometrends #movingtomiami #miamineighborhoods

#googlemaji

#homeownershipmatters #smarthomebuying #wealthbuildingtool #prioritizehomeownership #housingexpenses #buildnetworth #homeownershipbenefits

Published by Maji Pace Ramos on June 2, 2023

Published by Maji Pace Ramos on June 2, 2023

Published by Maji Pace Ramos on June 1, 2023

Buying and owning your home can make a big difference in your life by bringing you joy and a sense of belonging. And with June being National Homeownership Month, it’s the perfect time to think about all the benefits homeownership provides.

Of course, there are financial reasons to buy a house, but it’s important to consider the non-financial benefits that make a home more than just where you live.

Here are three ways owning your home can give you a sense of accomplishment, happiness, and pride.

You May Feel Happier and More Fulfilled

Owning a home is associated with better mental health and well-being. Gary Acosta, CEO and Co-Founder at the National Association of Hispanic Real Estate Professionals (NAHREP), explains:

“Studies have shown the emotional and psychological benefits that homeownership has on a person’s health and self-esteem . . .”

Similarly, Habitat for Humanity says:

“Residential stability among homeowners is related to improved life satisfaction, . . . along with better physical and mental health.”

Your home connects you to your community. Homeowners tend to stay in their homes longer than renters, and that can help you feel more connected to your community because you have more time to build meaningful relationships. And, as Acosta says, when people stay in the same area for a longer period of time, it can lead to them being more involved:

After all, it makes sense that someone would want to help improve the area they’re going to be living in for a while.You Can Customize and Improve Your Living Space

Your home is a place that’s all yours. When you own it, unless there are specific homeowner’s association requirements, you’re free to customize it however you see fit. Whether that’s small home improvements or full-on renovations, your house can be exactly what you want and need it to be. As your tastes and lifestyle change, so can your home. As Investopedia tells us:“One often-cited benefit of homeownership is the knowledge that you own your little corner of the world. You can customize your house, remodel, paint, and decorate without the need to get permission from a landlord.”

Owning your home can change your life in a way that gives you greater satisfaction and happiness. Let’s connect today if you’re ready to explore homeownership and all it has to offer.

Like “Majic” I’ll get it CLOSED!

(Maji) Maria Ramos Real Estate Advisor P.A

305-519-7940 | maji@majisold.com

Coldwell Banker Realty

• Miami Realtor since 1993

• 2nd Generation Realtor

• Expert Negotiator

• Market Trends Expert

• Miami native

• Bilingual – English & Spanish

• About me: https://linktr.ee/majisold

For the latest breaking news for the Miami Real Estate Market please subscribe to my blog or YouTube channel:

~ Maji’s Market Minute Blog on MiamiHomeTrends.com http://bit.ly/

~ YouTube channel: https://bit.ly/

#majiramosrealestateadvisorpa #miami_home_trends #majismarketminute

#majisold #majipaceramos #miamirealtor #miamirealestate #miamirealestategent

#majiramos #Miamirealetstatemarket #homesellinginmiami #miamilistingagent #miamihomesforsale #miamicondosforsale #priceyourhouseright

#homevaluation #zillow #zestimate #homecalculator #whatsmyhomeworth #hasmyhomegonedowninvalue #miamihometrends #movingtomiami #miamineighborhoods

#googlemaji #truevalue #homeownership #buildingwealth

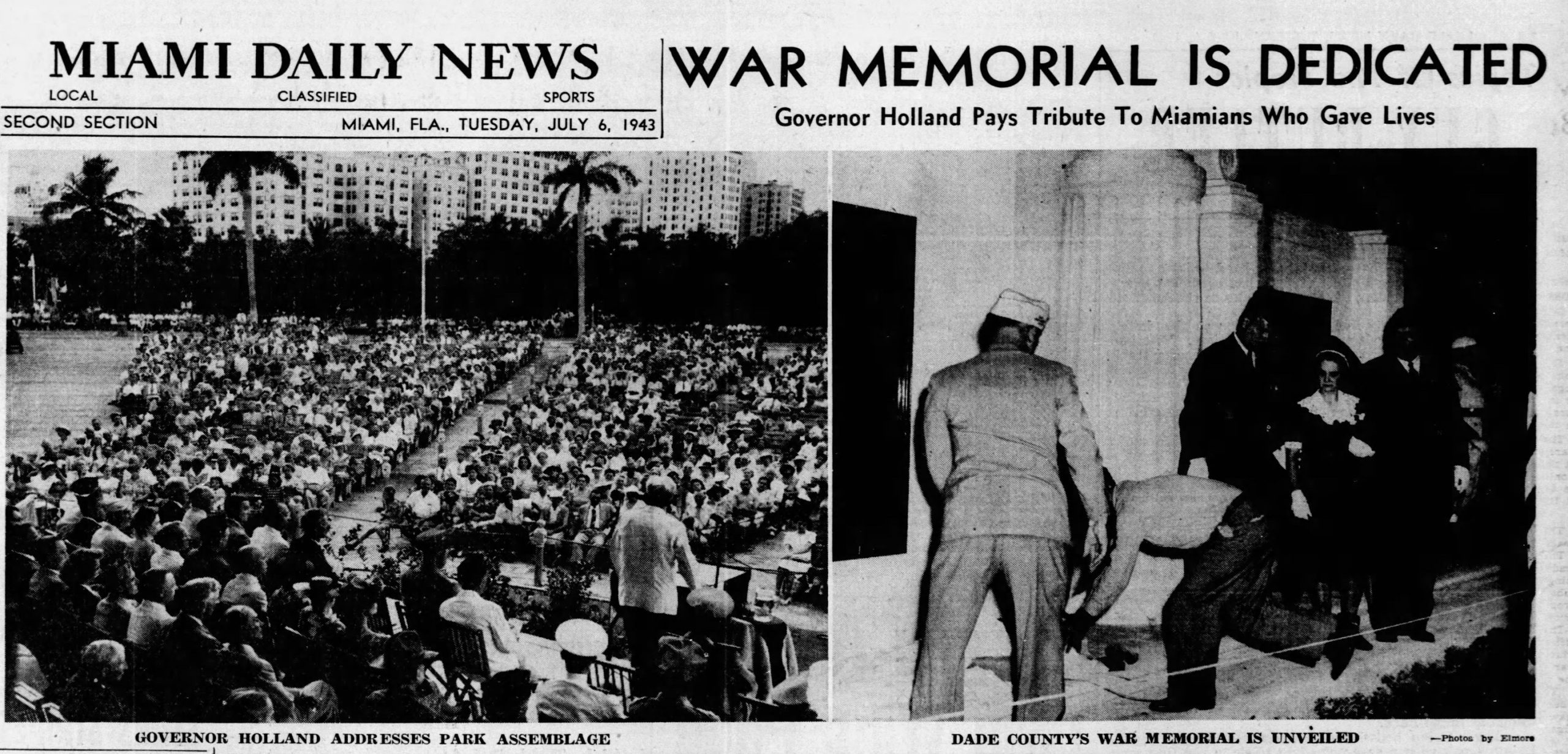

Published by Maji Pace Ramos on May 31, 2023

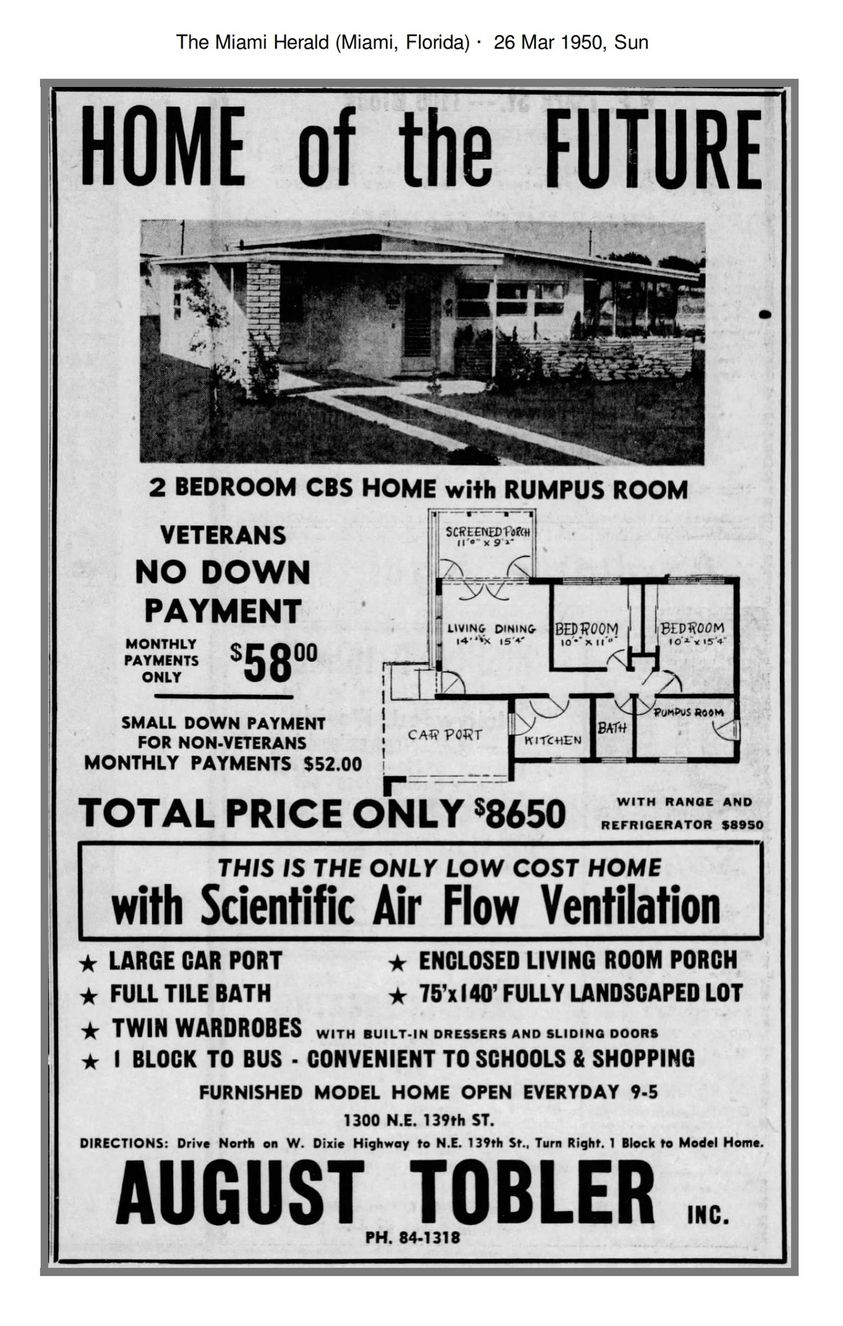

Wow!

(via FB/Miami History)

Published by Maji Pace Ramos on May 31, 2023

Comparing real estate metrics from one year to another can be challenging in a normal housing market. That’s due to possible variability in the market making the comparison less meaningful or accurate. Unpredictable events can have a significant impact on the circumstances and outcomes being compared.

Comparing this year’s numbers to the two ‘unicorn’ years we just experienced is almost worthless. By ‘unicorn,’ this is the less common definition of the word:

“Something that is greatly desired but difficult or impossible to find.”

The pandemic profoundly changed real estate over the last few years. The demand for a home of our own skyrocketed, and people needed a home office and big backyard.– Waves of first-time and second-home buyers entered the market.

– Already low mortgage rates were driven to historic lows.

– The forbearance plan all but eliminated foreclosures.

– Home values reached appreciation levels never seen before.

It was a market that forever had been “greatly desired but difficult or impossible to find.” A ‘unicorn’ year.

Now, things are getting back to normal. The ‘unicorns’ have galloped off.

Comparing today’s market to those years makes no sense. Here are three examples:

Buyer Demand

If you look at the headlines, you’d think there aren’t any buyers out there. We still sell over 10,000 houses a day in the United States. Of course, buyer demand is down from the two ‘unicorn’ years. But, according to ShowingTime, if we compare it to normal years (2017-2019), we can see that buyer activity is still strong (see graph below):

Home Prices

We can’t compare today’s home price increases to the last couple of years. According to Freddie Mac, 2020 and 2021, each had historic appreciation numbers. Here’s a graph also showing the more normal years (2017-2019):

We can see that we’re returning to more normal home value increases. There were several months of minimal depreciation in the second half of 2022. However, according to Fannie Mae, the market has returned to more normal appreciation in the first quarter of this year.

Foreclosures

There have already been some startling headlines about the percentage increases in foreclosure filings. Of course, the percentages will be up. They are increases over historically low foreclosure rates. Here’s a graph with information from ATTOM, a property data provider:

There will be an increase over the numbers of the last three years now that the moratorium on foreclosures has ended. There are homeowners who lose their homes to foreclosure every year, and it’s heartbreaking for those families. But, if we put the current numbers into perspective, we’ll realize that we’re actually going back to the normal filings from 2017-2019.

Bottom Line

There will be very unsettling headlines around the housing market this year. Most will come from inappropriate comparisons to the ‘unicorn’ years. Let’s connect so you have an expert on your side to help you keep everything in proper perspective.

Like “Majic” I’ll get it CLOSED!

(Maji) Maria Ramos Real Estate Advisor P.A

305-519-7940 | maji@majisold.com

Coldwell Banker Realty

• Miami Realtor since 1993

• 2nd Generation Realtor

• Expert Negotiator

• Market Trends Expert

• Miami native

• Bilingual – English & Spanish

• About me: https://linktr.ee/majisold

For the latest breaking news for the Miami Real Estate Market please subscribe to my blog or YouTube channel:

~ Maji’s Market Minute Blog on MiamiHomeTrends.com http://

~ YouTube channel: https://bit.ly/

#majiramosrealestateadvisorpa #miami_home_trends #majismarketminute

#majisold #majipaceramos #miamirealtor #miamirealestate #miamirealestategent

#majiramos #Miamirealetstatemarket #homesellinginmiami #miamilistingagent #miamihomesforsale #miamicondosforsale #priceyourhouseright

#homevaluation #zillow #zestimate #homecalculator #whatsmyhomeworth #hasmyhomegonedowninvalue #miamihometrends #movingtomiami #miamineighborhoods

#googlemaji #unicorns #realestatemarket

Published by Maji Pace Ramos on May 30, 2023

We have owned a vacation home for over 15 years and it is the place we truly relax. We call it “Fake Retirement” which isn’t even accurate as I work a lot from there but it’s still vaca.. ![]() For many of us visiting the same vacation spot every year is a summer tradition that’s fun, relaxing, and restful. Just the thought of not having to pack as much puts a smile on my face.

For many of us visiting the same vacation spot every year is a summer tradition that’s fun, relaxing, and restful. Just the thought of not having to pack as much puts a smile on my face. ![]() Nothing beats the feeling of turning on the road for our vacation home.

Nothing beats the feeling of turning on the road for our vacation home. ![]()

![]()

![]()

![]()

If that sounds like you, now’s the time to think about your plans and determine if buying a vacation home this year makes more sense than renting one again. According to Forbes:

“. . . if the idea of vacationing at the same place every year makes you feel instantaneously relaxed, buying a vacation home might be a wise move.”

To help you decide if making a move like this is right for you, let’s explore why you may want to consider purchasing a vacation home today.

Benefits of Owning Your Vacation Home

You don’t have to worry about finding a place to stay. It can be a challenge to find a rental where you want when you want. Some summer vacation destinations are more popular than others, meaning your favorite place may be booked up in advance. Bankrate explains why owning your vacation home means you don’t have to worry about that sort of inconvenience:

“. . . a second home can offer a place to have quality time with your family and ensures that you always have a vacation destination.”

It’s an investment. Home values typically appreciate over the long haul. That holds true for your vacation home as well, especially if it’s in an area with growing market demand. This can help grow your net worth with time.

Vacation homes may provide tax benefits. If you own a vacation home, you may be eligible for tax deductions based on where it is. However, before buying, you’ll want to consult with a tax professional to discuss first as taxes can vary by location.

It could potentially turn into a retirement location. If you love the location of your vacation home, you could potentially sell your primary residence and retire there in the future.

How a Pro Can Help You Find Your Perfect Match

As you’re preparing for summer vacation, remember, you could potentially visit your second home instead of another rental unit or hotel. If that sounds appealing to you, a local real estate agent is your best resource. They have the knowledge and resources to help you understand the area and what vacation homes are available in your budget. Plus, these agents can explain the perks of how owning a second home can benefit you.

There are very different considerations when purchasing a second home, especially one you intend on working from as well. Ideally, you should work with an agent that owns one. As a second homeowner for 17 years, I know what to look for. If it isn’t in my market don’t fret, I have taken years cultivating my real estate agent sphere. I know and refer to realtors around the world.

Bottom Line

If any of these reasons for owning a vacation home resonate with you, let’s connect. You still have time to enjoy spending the summer in your vacation home.

Like “Majic” I’ll get it CLOSED!

(Maji) Maria Ramos Real Estate Advisor P.A

305-519-7940 | maji@majisold.com

Coldwell Banker Realty

• Miami Realtor since 1993

• 2nd Generation Realtor

• Expert Negotiator

• Market Trends Expert

• Miami native

• Bilingual – English & Spanish

• About me: https://linktr.ee/majisold

For the latest breaking news for the Miami Real Estate Market please subscribe to my blog or YouTube channel:

~ Maji’s Market Minute Blog on MiamiHomeTrends.com http://bit.ly/

~ YouTube channel: https://bit.ly/

#vacationhomesflorida #miamivacationhomes #1031exchange

#majiramosrealestateadvisorpa #miami_home_trends #majismarketminute

#majisold #majipaceramos #miamirealtor #miamirealestate #miamirealestategent

#majiramos #Miamirealetstatemarket #homesellinginmiami #miamilistingagent #miamihomesforsale #miamicondosforsale #priceyourhouseright

#homevaluation #zillow #zestimate #homecalculator #whatsmyhomeworth #hasmyhomegonedowninvalue #miamihometrends #movingtomiami #miamineighborhoods

#googlemaji #vacationhome #vacation #summer add #vacationhomemiami #vacationhomeflorida

Published by Maji Pace Ramos on May 29, 2023

Published by Maji Pace Ramos on May 26, 2023

Something to consider on Memorial Day Weekend before setting off fireworks. 🧐

Fireworks are beautiful 🎇 but for our Veterans sufferings from PTSD it’s can be a terrifying trigger. Imagine being in a war zone and the struggle of

coming back to civilian life and compound that with our love of fireworks as a form of celebration. It is difficult for the brain to differentiate between the sound of gunfire and fireworks especially w PTSD.

I was a USAA certified agent and worked with military families for years and have always thought that fireworks on Memorial Day was so very odd.

Memorial Day is a holiday that honors our Veterans and those that have given the ultimate sacrifice. Lets not make this day more difficult for the very people we are honoring.

#fireworksandptsd #fireworksandveterans #fireworks #memorialday2023 #googlemaji #majiramosrealestateadvisorpa #majigreeninitiative #fireworksdisplay #USAA #veterans

Published by Maji Pace Ramos on May 25, 2023

If you’re trying to decide if now’s the time to sell your house, here’s what you should know. The limited number of homes available right now gives you a big advantage. That’s because there are more buyers out there than there are homes for sale. And, with so few homes on the market, buyers will have fewer options, so you set yourself up to get the most eyes possible on your house.

Here’s what industry experts are saying about why selling now has its benefits:

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR):

“Inventory levels are still at historic lows. Consequently, multiple offers are returning on a good number of properties.”

Selma Hepp, Chief Economist at CoreLogic:

“We have not seen the traditional uptick in new listings from existing homeowners, so undersupply of housing will continue to heighten market competition and put pressure on prices in most regions. Some markets are already heating up considerably, but price premiums that we saw last spring and summer are unlikely.”

Clare Trapasso, Executive News Editor at Realtor.com:

“Well-priced, move-in ready homes with curb appeal in desirable areas are still receiving multiple offers and selling for over the asking price in many parts of the country . . .”

Jeff Tucker, Senior Economist at Zillow:“

If you’re thinking about selling your house, let’s connect so you have the expert insights you need to make the best possible move today.

305-519-7940 | maji@majisold.com

Coldwell Banker Realty• Miami Realtor since 1993

• 2nd Generation Realtor

• Expert Negotiator

• Market Trends Expert

• Miami native

• Bilingual – English & Spanish

• About me: https://linktr.ee/majisoldFor the latest breaking news for the Miami Real Estate Market please subscribe to my blog or YouTube channel:~ Maji’s Market Minute Blog on MiamiHomeTrends.com http://bit.ly/

~ YouTube channel: https://bit.ly/

#majisold #majipaceramos #miamirealtor #miamirealestate #miamirealestategent

#majiramos #Miamirealetstatemarket #homesellinginmiami #miamilistingagent #miamihomesforsale #miamicondosforsale #priceyourhouseright

#homevaluation #zillow #zestimate #homecalculator #whatsmyhomeworth #hasmyhomegonedowninvalue #miamihometrends #movingtomiami #miamineighborhoods

#googlemaji

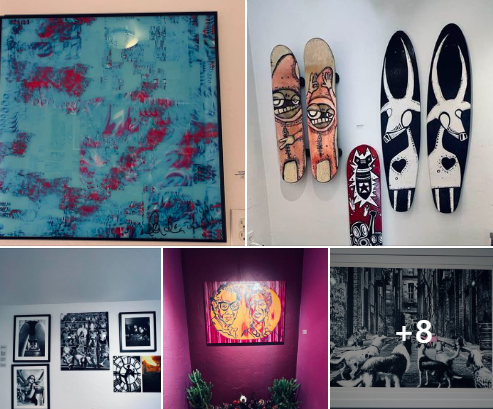

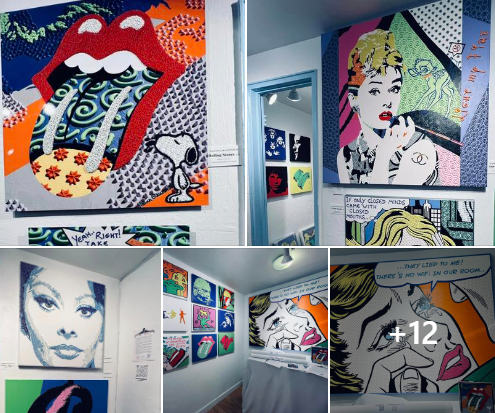

Highlights of the Morningside Home Tour Volunteer Brunch

#morningsidehometour

#historichomesofmorningside

#morningsidehometour2023 #morningside #googlemaji #morningsidepark #historichomesmiami #majismarketminute #Cushman #majigreeninitiative

Published by Maji Pace Ramos on May 24, 2023

You’re probably feeling the impact of high inflation every day as prices have gone up on groceries, gas, and more. If you’re a renter, you’re likely experiencing it a lot as your rent continues to rise. Between all of those elevated costs and uncertainty about a potential recession, you may be wondering if it still makes sense to buy a home today. The short answer is – it does. Here’s why.

Homeownership actually shields you from the rising costs inflation brings.

Freddie Mac explains how:

“Not only will buying today help you begin to build equity, a fixed-rate mortgage can stabilize your monthly housing costs for the long-term even while other life expenses continue to rise – as has been the case the past few years.”

Unlike rents, which tend to rise with time, a fixed-rate mortgage payment is predictable over the life of the mortgage (typically 15 to 30 years). And, when the cost of most everything else is rising, keeping your housing payment stable is especially important.The alternative to homeownership is renting – and rents tend to move alongside inflation. That means as inflation goes up, your monthly rent payments tend to go up, too (see graph below):

A stable housing payment is especially important in times of high inflation. Let’s connect so you can learn more and start your journey to homeownership today.Like “Majic” I’ll get it CLOSED!(Maji) Maria Ramos Real Estate Advisor P.A

305-519-7940 | maji@majisold.com

Coldwell Banker Realty• Miami Realtor since 1993

• 2nd Generation Realtor

• Expert Negotiator

• Market Trends Expert

• Miami native

• Bilingual – English & Spanish

• About me: https://linktr.ee/majisoldFor the latest breaking news for the Miami Real Estate Market please subscribe to my blog or YouTube channel:~ Maji’s Market Minute Blog on MiamiHomeTrends.com http://

~ YouTube channel: https://bit.ly/

#majisold #majipaceramos #miamirealtor #miamirealestate #miamirealestategent

#majiramos #Miamirealetstatemarket #homesellinginmiami #miamilistingagent #miamihomesforsale #miamicondosforsale #priceyourhouseright

#homevaluation #zillow #zestimate #homecalculator #whatsmyhomeworth #hasmyhomegonedowninvalue #miamihometrends #movingtomiami #miamineighborhoods

#googlemaji #tipsforbuyers #inflation #homeownership

The process of buying a home can feel a bit intimidating, even under normal circumstances. But today’s market is still anything but normal. There continues to be a very limited number of homes for sale, and that’s creating bidding wars and driving home prices back up as buyers compete over the available homes.

Navigating all of this can be daunting if you’re trying to do it alone. That’s why having a skilled expert to guide you through the homebuying process is essential, especially today. Bankrate shares this perspective:

“Advice and guidance from a professional real estate agent can be invaluable, particularly amid a hot or unpredictable housing market.”

Experience – Real estate professionals know the ins and outs of what’s happening today, how it impacts buyers, and how to navigate any hurdles that may pop up.

Negotiations – Your real estate advisor advocates for your best interests. Having an expert on your side provides assistance with the purchase agreement. An agent can also help you negotiate potential seller concessions if the inspection reveals issues with the home.

Pricing – Making an offer and negotiating with a seller can be one of the most difficult and stressful parts of the homebuying process. A skilled agent will help you understand what similar homes are selling for so you have the full picture of what you may want to offer.

All of these reasons combined may be why 86% of recent buyers used an agent according to the latest Home Buyers and Sellers Generational Trends Report from the National Association of Realtors (NAR). NAR also has this to say about why an agent is so essential today:“A great real estate agent will guide you through the home search with an unbiased eye, helping you meet your buying objectives while staying within your budget. Agents are also a great source when you have questions about local amenities, utilities, zoning rules, contractors, and more.”

What’s the Key To Choosing the Right Expert?

It starts with trust. You’ll want to know you can trust the advice they’re giving you, so you need to make sure you’re connected with a true professional. No one can provide perfect advice because it’s impossible to know exactly what’s going to happen at every turn – especially in today’s market. But a true professional can give you the best possible advice based on the information and situation at hand.

They’ll help advocate for you throughout the process and coach you on the essential knowledge you need to make confident decisions. That’s exactly what you want and deserve.

Bottom Line

It’s critical to have an expert on your side who is skilled in navigating today’s housing market. If you’re planning to buy a home this year, let’s connect so you have a real estate advisor on your side to give you the best advice and guide you along the way.

Like “Majic” I’ll get it CLOSED!

(Maji) Maria Ramos Real Estate Advisor P.A

305-519-7940 | maji@majisold.com

Coldwell Banker Realty

• Miami Realtor since 1993

• 2nd Generation Realtor

• Expert Negotiator

• Market Trends Expert

• Miami native

• Bilingual – English & Spanish

• About me: https://linktr.ee/majisold

For the latest breaking news for the Miami Real Estate Market please subscribe to my blog or YouTube channel:

~ Maji’s Market Minute Blog on MiamiHomeTrends.com http://bit.ly/

~ YouTube channel: https://bit.ly/

#majiramosrealestateadvisorpa #miami_home_trends #majismarketminute

#majisold #majipaceramos #miamirealtor #miamirealestate #miamirealestategent

#majiramos #Miamirealetstatemarket #priceyourhouseright

#homevaluation #zillow #zestimate #homecalculator #whatsmyhomeworth #hasmyhomegonedowninvalue #miamihometrends #movingtomiami #miamineighborhoods

#googlemaji

Published by Maji Pace Ramos on May 19, 2023

If you’re thinking about buying a home, you want to know the decision will be a good one. And for many, that means thinking about what home prices are projected to do in the coming years and how that could impact your investment.

This year, we aren’t seeing home prices fall dramatically. As the year goes on, however, some markets may go up in value while others may lose value. That’s why it’s helpful to keep the long-term view in mind. Experts project a return to a steadier rate of price appreciation in the years that follow.

Home Price Appreciation in the Years Ahead

Over 100 economists, investment strategists, and housing market analysts were polled by Pulsenomics in their latest quarterly Home Price Expectation Survey (HPES). The report indicates what they believe will happen with home prices over the next five years. As the graph below shows, after mild depreciation this year, these experts forecast home prices will return to more normal levels of appreciation through 2027.

The big takeaway is experts aren’t forecasting a drastic fall in home prices nationally, even though some markets will see home price appreciation while others may depreciate. And when they look further out, they see steady price appreciation in the long run. That’s a great example of why homeownership wins over time.

What Does This Mean for You?

Once you buy a home, price appreciation raises your home’s value, and that grows your household wealth. Here’s how a typical home’s value could change over the next few years using the expert price appreciation projections from the survey mentioned above (see graph below):

In this example, if you bought a $400,000 home at the beginning of this year and factor in the forecast from the HPES, you could accumulate over $54,000 in household wealth over the next five years. So, if you’re wondering if buying a home is a sound decision, keep in mind what a strong wealth-building tool it is long term.

Bottom Line

According to the experts, while we may see slight depreciation this year, home prices are expected to grow over the next five years. If you’re ready to become a homeowner, know that buying today can set you up for long-term success as home values (and your own net worth) are projected to grow. Let’s connect to begin the homebuying process today.

Like “Majic” I’ll get it CLOSED!

(Maji) Maria Ramos Real Estate Advisor P.A

305-519-7940 | maji@majisold.com

Coldwell Banker Realty

• Miami Realtor since 1993

• 2nd Generation Realtor

• Expert Negotiator

• Market Trends Expert

• Miami native

• Bilingual – English & Spanish

• About me: https://linktr.ee/majisold

For the latest breaking news for the Miami Real Estate Market please subscribe to my blog or YouTube channel:

~ Maji’s Market Minute Blog on MiamiHomeTrends.com http://bit.ly/

~ YouTube channel: https://bit.ly/

#majiramosrealestateadvisorpa #miami_home_trends #majismarketminute

#majisold #majipaceramos #miamirealtor #miamirealestate #miamirealestategent

#majiramos #Miamirealetstatemarket #homesellinginmiami #miamilistingagent #miamihomesforsale #miamicondosforsale #priceyourhouseright

#homevaluation #zillow #zestimate #homecalculator #whatsmyhomeworth #hasmyhomegonedowninvalue #miamihometrends #movingtomiami #miamineighborhoods

#googlemaji

Use these tips to make your best offer in today’s sellers’ market. Let’s connect so I can help you buy that home you’ve been wanting.

Like “Majic” I’ll get it CLOSED!

(Maji) Maria Ramos Real Estate Advisor P.A

305-519-7940 | maji@majisold.com

Coldwell Banker Realty

• Miami Realtor since 1993

• 2nd Generation Realtor

• Expert Negotiator

• Market Trends Expert

• Miami native

• Bilingual – English & Spanish

• About me: https://linktr.ee/majisold

For the latest breaking news for the Miami Real Estate Market please subscribe to my blog or YouTube channel:

~ Maji’s Market Minute Blog on MiamiHomeTrends.com http://bit.ly/majismarketminute-blog

~ YouTube channel: https://bit.ly/MajisMarketMinute

#majiramosrealestateadvisorpa #miami_home_trends #majismarketminute

#majisold #majipaceramos #miamirealtor #miamirealestate #miamirealestategent

#majiramos #Miamirealetstatemarket #homesellinginmiami #miamilistingagent #miamihomesforsale #miamicondosforsale #priceyourhouseright

#homevaluation #zillow #zestimate #homecalculator #whatsmyhomeworth #hasmyhomegonedowninvalue #miamihometrends #movingtomiami #miamineighborhoods

#googlemaji #todaysmarket #buyerstips #homebuying #homebuyingmiami

Published by Maji Pace Ramos on May 17, 2023

If you’re thinking about selling this spring, it’s time to get moving – the best week to list your house is fast approaching.

Experts at realtor.com looked at seasonal trends from recent years (excluding 2020 as an uncharacteristic year due to the onset of the pandemic) and determined the ideal week to list a house this year:

“Home sellers on the fence waiting for that perfect moment to sell should start preparations, because the best time to list a home in 2023 is approaching quickly. The week of April 16-22 is expected to have the ideal balance of housing market conditions that favor home sellers, more so than any other week in the year.”

If you’ve been waiting for the best time to sell, this is your chance. But remember, before you put your house on the market, you’ve got to get it ready. And if you haven’t started that process yet, you’ll need to move quickly. Here’s what you should keep in mind.Work with an Agent To Determine Which Updates To Make

Start by prioritizing which updates you’ll make. In February, realtor.com asked more than 1,200 recent or potential home sellers what updates they ended up making to their house before listing it (see graph below):

As you can see, the most common answers included landscaping and painting. Work with a trusted real estate agent to determine what projects make the most sense for your goals and local market.If Possible, Plan To Have Your House Staged

Once you’ve made any necessary repairs and updates to your house, consider having it staged. According to the National Association of Realtors (NAR), 82% of buyers’ agents said staging a home made it easier for a buyer to visualize the property as a future home. Additionally, almost half of buyers’ agents said home staging had an effect on most buyers’ view of the home in general. Homes that are staged typically sell faster and for a higher price because they help potential buyers more easily picture their new life in the house.Bottom Line

Are you ready to sell this spring? Let’s connect to plan your next steps. You can start by making a checklist of what you think your house needs to get ready. Then, we can work together to prioritize your list and move forward together.

Like “Majic” I’ll get it CLOSED!

(Maji) Maria Ramos Real Estate Advisor P.A

305-519-7940 | maji@majisold.com

Coldwell Banker Realty

• Miami Realtor since 1993

• 2nd Generation Realtor

• Expert Negotiator

• Market Trends Expert

• Miami native

• Bilingual – English & Spanish

• About me: https://linktr.ee/majisold

For the latest breaking news for the Miami Real Estate Market please subscribe to my blog or YouTube channel:

~ Maji’s Market Minute Blog on MiamiHomeTrends.com http://bit.ly/

~ YouTube channel: https://bit.ly/

#majiramosrealestateadvisorpa #miami_home_trends #majismarketminute

#majisold #majipaceramos #miamirealtor #miamirealestate #miamirealestategent

#majiramos #Miamirealetstatemarket #homesellinginmiami #miamilistingagent #miamihomesforsale #miamicondosforsale #priceyourhouseright

#homevaluation #zillow #zestimate #homecalculator #whatsmyhomeworth #hasmyhomegonedowninvalue #miamihometrends #movingtomiami #miamineighborhoods

#googlemaji

Published by Maji Pace Ramos on May 16, 2023

Published by Maji Pace Ramos on May 16, 2023

If you’re reading headlines about inflation or mortgage rates, you may see something about the recent decision from the Federal Reserve (the Fed). But what does it mean for you, the housing market, and your plans to buy a home? Here’s what you need to know.

Inflation and the Housing Market

While the Fed’s working hard to lower inflation, the latest data shows that, while the number has improved some, the inflation rate is still higher than the target (2%). That played a role in the Fed’s decision to raise the Federal Funds Rate last week. As Bankrate explains:

“Keeping its inflation-fighting streak alive, the Federal Reserve has raised interest rates for the 10th time in 10 meetings . . . The hikes aimed to cool an economy that was on fire after rebounding from the coronavirus recession of 2020.”

While the Fed’s actions don’t directly dictate what happens with mortgage rates, their decisions do have an impact and contributed to the intentional cooldown in the housing market last year.

How This Impacts You

During times of high inflation, your everyday expenses go up. That means you’ve likely felt the pinch at the gas pump and in the grocery store. By raising the Federal Funds Rate, the Fed is actively trying to lower inflation. If the Fed is successful, it could also ultimately lead to lower mortgage rates and better homebuying affordability for you. That’s because when inflation is high, mortgage rates tend to be high. But, as inflation cools, experts say mortgage rates will likely fall.

Where Experts Think Mortgage Rates and Inflation Will Go from Here

Moving forward, both inflation and mortgage rates will continue to impact the housing market. And as Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“Mortgage rates are likely to descend lower later in the year as the consumer price inflation calms down . . .”

Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), explains:“We continue to expect that mortgage rates will drift down over the course of the year as the economy slows . . .”

Don’t let headlines about the latest decision from the Fed confuse you. Where mortgage rates go from here depends on what happens with inflation. If inflation cools, mortgage rates should tick down as a result. Let’s connect so you have expert insights on housing market changes and what they mean for you.

Like “Majic” I’ll get it CLOSED!

(Maji) Maria Ramos Real Estate Advisor P.A

305-519-7940 | maji@majisold.com

Coldwell Banker Realty

• Miami Realtor since 1993

• 2nd Generation Realtor

• Expert Negotiator

• Market Trends Expert

• Miami native

• Bilingual – English & Spanish

• About me: https://linktr.ee/majisold

For the latest breaking news for the Miami Real Estate Market please subscribe to my blog or YouTube channel:

~ Maji’s Market Minute Blog on MiamiHomeTrends.com http://bit.ly/

~ YouTube channel: https://bit.ly/

#majiramosrealestateadvisorpa #miami_home_trends #majismarketminute

#majisold #majipaceramos #miamirealtor #miamirealestate #miamirealestategent

#majiramos #Miamirealetstatemarket #homesellinginmiami #miamilistingagent #miamihomesforsale #miamicondosforsale #priceyourhouseright

#homevaluation #zillow #zestimate #homecalculator #whatsmyhomeworth #hasmyhomegonedowninvalue #miamihometrends #movingtomiami #miamineighborhoods

#googlemaji #mortgagerates

Published by Maji Pace Ramos on May 15, 2023

FLASH SALE: USE mom code

Published by Maji Pace Ramos on May 15, 2023

Mother’s Day celebration.

Published by Maji Pace Ramos on May 15, 2023

Mother’s Day can be a painful time, especially for people living with loss. Author Rebecca Soffer shares ideas for how to care for yourself or loved ones on a tough day.

Over 25 neighbors so far maybe more.

Most in favor. I expressed my concern with drainage of the seawall so it does not become a retention pool and potentially flood out our neighborhood.

The seawall addresses sea rise but not flooding from rain which is much more common.

What do you think?? How do you feel about the flooding in the park and this project?

I am proud of our neighbors that are here. 😊

#morningsidemiami_life #morningsidepark #morningsideparkshorelineproject #climatechange #searise #climatechangesolutions #majigreen #majigreensustainablesolutions #googlemaji #majiramosrealestateadvisor

#morningsidehometour2023 #morningsidemiami #Zoi #miamihistorichomes #historichomesofmorningside #morningsidemiami_life

Published by Maji Pace Ramos on May 10, 2023

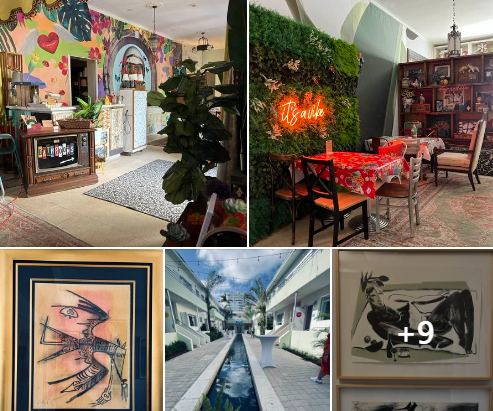

Morningside is a Bayfront historic community. We are actually the first historically designated community in Miami and we are having our historic home tour this month on the 21st in conjunction with our 100-year anniversary party.

This will be a very special event and will attract many people. We have not had a tour since 2019!

In addition to the historic home and garden tour, we are going to have a vendor showcase, food trucks, and a VIP experience. This is all new this year.

There are some sponsorship opportunities starting at $500. Anything from print ads to vendor tables.

THE DEADLINE IS FRIDAY!!

Please contact me. For more information.

Thank you.

Celebrating 100 Years: Morningside Historic Home Tour

https://docs.google.com/

(Maji) Maria Ramos Real Estate Advisor P.A

305-519-7940 | maji@majisold.com

Coldwell Banker Realty

• Miami Realtor since 1993

• 2nd Generation Realtor

• Expert Negotiator

• Market Trends Expert

• Miami native

• Morningside resident since 2002

• Bilingual – English & Spanish

• About me: https://linktr.ee/majisold

~ Maji’s Market Minute Blog on MiamiHomeTrends.com http://bit.ly/

~ YouTube channel: https://bit.ly/

#morningsidemiami #historichomesmiami #bayfrontneighborhoods

#majiramosrealestateadvisorpa #miami_home_trends #majismarketminute

#majisold #majipaceramos #miamirealtor #miamirealestate #miamirealestategent

#majiramos #Miamirealetstatemarket #homesellinginmiami #miamilistingagent #miamihomesforsale #miamicondosforsale #priceyourhouseright

#homevaluation #zillow #zestimate #homecalculator #whatsmyhomeworth #hasmyhomegonedowninvalue #miamihometrends #movingtomiami #miamineighborhoods

#googlemaji #morningside #historiccommunity #bayfront #100yearanniversary

Published by Maji Pace Ramos on May 9, 2023

My grandfather had ac in Cuba in the 1950’s but then again he was brilliant. He designed and built it for his home. Well at least the primary bdrm and his office. ![]()

(via FB/Ron Richter/FLASHBACK South Florida – Memories and Memorabilia)

Published by Maji Pace Ramos on May 9, 2023

So this is what’s being built at the old Planetarium. Looking forward to seeing what Viscaya does with it.

(via FB/Larry Shane/FLASHBACK South Florida – Memories and Memorabilia)

Published by Maji Pace Ramos on May 9, 2023

Who remembers the Pink Floyd Laser Light shows? They were so awesome! These pics bring me back. Good times. ![]()

![]()

![]()

![]() Sad that it’s now gone.

Sad that it’s now gone.![]()

(via FB/Larry Shane/FLASHBACK South Florida – Memories and Memorabilia)

Published by Maji Pace Ramos on May 9, 2023

Why Today’s Housing Market Is Not About To Crash

There’s been some concern lately that the housing market is headed for a crash. And given some of the affordability challenges in the housing market, along with a lot of recession talk in the media, it’s easy enough to understand why that worry has come up.

But the data clearly shows today’s market is very different than it was before the housing crash in 2008. Rest assured, this isn’t a repeat of what happened back then. Here’s why.

It’s Harder To Get a Loan Now

It was much easier to get a home loan during the lead-up to the 2008 housing crisis than it is today. Back then, banks had different lending standards, making it easy for just about anyone to qualify for a home loan or refinance an existing one. As a result, lending institutions took on much greater risk in both the person and the mortgage products offered. That led to mass defaults, foreclosures, and falling prices.

Things are different today as purchasers face increasingly higher standards from mortgage companies. The graph below uses data from the Mortgage Bankers Association (MBA) to show this difference. The lower the number, the harder it is to get a mortgage. The higher the number, the easier it is.

Unemployment Recovered Faster This Time

While the pandemic caused unemployment to spike over the last couple of years, the jobless rate has already recovered back to pre-pandemic levels (see the blue line in the graph below). Things were different during the Great Recession as a large number of people stayed unemployed for a much longer period of time (see the red in the graph below):

Here’s how the quick job recovery this time helps the housing market. Because so many people are employed today, there’s less risk of homeowners facing hardship and defaulting on their loans. This helps put today’s housing market on stronger footing and reduces the risk of more foreclosures coming onto the market.

There Are Far Fewer Homes for Sale Today

There were also too many homes for sale during the housing crisis (many of which were short sales and foreclosures), and that caused prices to fall dramatically. Today, there’s a shortage of inventory available overall, primarily due to years of underbuilding homes.

The graph below uses data from the National Association of Realtors (NAR) and the Federal Reserve to show how the months’ supply of homes available now compares to the crash. Today, unsold inventory sits at just a 2.6-months’ supply. There just isn’t enough inventory on the market for home prices to come crashing down like they did in 2008.

Equity Levels Are Near Record Highs

That low inventory of homes for sale helped keep upward pressure on home prices over the course of the pandemic. As a result, homeowners today have near-record amounts of equity (see graph below):

And, that equity puts them in a much stronger position compared to the Great Recession. Molly Boesel, Principal Economist at CoreLogic, explains:

“Most homeowners are well positioned to weather a shallow recession. More than a decade of home price increases has given homeowners record amounts of equity, which protects them from foreclosure should they fall behind on their mortgage payments.”

Bottom Line

The graphs above should ease any fears you may have that today’s housing market is headed for a crash. The most current data clearly shows that today’s market is nothing like it was last time

Like “Majic” I’ll get it CLOSED!

(Maji) Maria Ramos Real Estate Advisor P.A

305-519-7940 | maji@majisold.com

Coldwell Banker Realty

• Miami Realtor since 1993

• 2nd Generation Realtor

• Expert Negotiator

• Market Trends Expert

• Miami native

• Bilingual – English & Spanish

• About me: https://linktr.ee/majisold

For the latest breaking news for the Miami Real Estate Market please subscribe to my blog or YouTube channel:

~ Maji’s Market Minute Blog on MiamiHomeTrends.com http://bit.ly/

~ YouTube channel: https://bit.ly/

#majiramosrealestateadvisorpa #miami_home_trends #majismarketminute

#majisold #majipaceramos #miamirealtor #miamirealestate #miamirealestategent

#majiramos #Miamirealetstatemarket #homesellinginmiami #miamilistingagent #miamihomesforsale #miamicondosforsale #priceyourhouseright

#homevaluation #zillow #zestimate #homecalculator #whatsmyhomeworth #hasmyhomegonedowninvalue #miamihometrends #movingtomiami #miamineighborhoods

#googlemaji

Published by Maji Pace Ramos on May 8, 2023

Published by Maji Pace Ramos on May 8, 2023

Wondering if you should continue renting or if you should buy a home this year? If so, consider this. Rental affordability is still a challenge and has been for years. That’s because, historically, rents trend up over time. Data from the Census shows rents have been climbing pretty steadily since 1988.

And, data from the latest rental report from Realtor.com shows rents continue to grow today, even though it’s at a slower pace than we saw at the height of the pandemic:

“In March 2023, the U.S. rental market experienced single-digit growth for the eighth month in a row . . . The median asking rent was $1,732, up by $15 from last month and down by $32 from the peak but is still $354 (25.7%) higher than the same time in 2019 (pre-pandemic).”

The graph below uses national data on the median rental payment from Realtor.com and median mortgage payment from the National Association of Realtors (NAR) to compare the two options. As the graph shows, depending on how much space you need, it’s typically more affordable to own than to rent if you need two or more bedrooms:So, if you’re looking to live somewhere where you have two or more bedrooms to accommodate your household, give you more breathing room to spread out your belongings, or dedicate the extra space to practice your hobbies, it might make sense to consider homeownership.Homeownership Allows You To Start Building Equity

In addition to shielding you from rising rents and being more affordable when you need more space, owning your home also allows you to start building your own equity, which in turn grows your net worth.And, as home values typically rise over time and you pay off your mortgage, you build equity. That equity can set you up for success later on because you can use it to help fuel a move to an even bigger space down the line. That’s why, according to Zonda, the top reason millennial homeowners bought their home over the past year was to build their own equity instead of someone else’s.Bottom Line

If you’re trying to decide whether to buy a home or continue renting, let’s connect to explore your options. With rents rising, it may make more sense to pursue your dream of homeownership.

• About me: https://linktr.ee/majisold

For the latest breaking news for the Miami Real Estate Market please subscribe to my blog or YouTube channel:

Like “Majic” I’ll get it CLOSED!

(Maji) Maria Ramos Real Estate Advisor P.A

305-519-7940 | maji@majisold.com

Coldwell Banker Realty

• Miami Realtor since 1993

• 2nd Generation Realtor

• Expert Negotiator

• Market Trends Expert

• Miami native

• Bilingual – English & Spanish

• About me: https://linktr.ee/majisold

For the latest breaking news for the Miami Real Estate Market please subscribe to my blog or YouTube channel:

~ Maji’s Market Minute Blog on MiamiHomeTrends.com http://

~ YouTube channel: https://bit.ly/

#majiramosrealestateadvisorpa #miami_home_trends #majismarketminute

#majisold #majipaceramos #miamirealtor #miamirealestate #miamirealestategent

#majiramos #Miamirealetstatemarket #homesellinginmiami #miamilistingagent #miamihomesforsale #miamicondosforsale #priceyourhouseright

#homevaluation #zillow #zestimate #homecalculator #whatsmyhomeworth #hasmyhomegonedowninvalue #miamihometrends #movingtomiami #miamineighborhoods

#googlemaji

Published by Maji Pace Ramos on May 5, 2023

Downsizing has long been a popular option when homeowners reach retirement age. But there are plenty of other life changes that could make downsizing worthwhile. Homeowners who have experienced a change in their lives or no longer feel like their house fits their needs may benefit from downsizing too. U.S. News explains:

“Downsizing is somewhat common among older people and retirees who no longer have children living at home. But these days, younger people are also looking to downsize to save money on housing . . .”

And when inflation has made most things significantly more expensive, saving money where you can has a lot of appeal. So, if you’re thinking about ways to budget differently, it could be worthwhile to take your home into consideration.When you think about cutting down on your spending, odds are you think of frequent purchases, like groceries and other goods. But when you downsize your house, you often end up downsizing the bills that come with it, like your mortgage payment, energy costs, and maintenance requirements. Realtor.com shares:

“A smaller home typically means lower bills and less upkeep. Then there’s the potential windfall that comes from selling your larger home and buying something smaller.”

That windfall is thanks to your home equity. If you’ve been in your house for a while, odds are you’ve developed a considerable amount of equity. Your home equity is an asset you can use to help you buy a home that better suits your needs today.And when you’re ready to make a move, your team of real estate experts will be your guides through every step of the process. That includes setting the right price for your house when you sell, finding the best location and size for your next home, and understanding what you can afford at today’s mortgage rate.

What This Means for You

If you’re thinking about downsizing, ask yourself these questions:

- Do the original reasons I bought my current house still stand, or have my needs changed since then?

- Do I really need and want the space I have right now, or could somewhere smaller be a better fit?

- What are my housing expenses right now, and how much do I want to try to save by downsizing?

Once you know the answers to these questions, meet with a real estate advisor to get an answer to this one: What are my options in the market right now? A local housing market professional can walk you through how much equity you have in your house and how it positions you to win when you downsize.

Bottom Line

If you’re looking to save money, downsizing your home could be a great help toward your goal. Let’s connect to talk about your goals in the housing market this year.

Like “Majic” I’ll get it CLOSED!

(Maji) Maria Ramos Real Estate Advisor P.A

305-519-7940 | maji@majisold.com

Coldwell Banker Realty

• Miami Realtor since 1993

• 2nd Generation Realtor

• Expert Negotiator

• Market Trends Expert

• Miami native

• Bilingual – English & Spanish

• About me: https://linktr.ee/majisold

For the latest breaking news for the Miami Real Estate Market please subscribe to my blog or YouTube channel:

~ Maji’s Market Minute Blog on MiamiHomeTrends.com http://bit.ly/

~ YouTube channel: https://bit.ly/

#majiramosrealestateadvisorpa #miami_home_trends #majismarketminute

#majisold #majipaceramos #miamirealtor #miamirealestate #miamirealestategent

#majiramos #Miamirealetstatemarket #homesellinginmiami #miamilistingagent #miamihomesforsale #miamicondosforsale #priceyourhouseright

#homevaluation #zillow #zestimate #homecalculator #whatsmyhomeworth #hasmyhomegonedowninvalue #miamihometrends #movingtomiami #miamineighborhoods

#googlemaji

Okay, so what’s going on in our market? Every time I travel, it’s like everything explodes. I had a new listing that went online right before I left town that went under contract while I was out of town. I was negotiating that and the inspections. I had another property that wasn’t even on the market that we’re negotiating a contract on right now and a buyer that presented an offer on a short sale. All of this happened while I was out of town so I was negotiating remotely and my team was handling anything that required a physical presence.

So what am I seeing? I’m seeing properties that are still going above list price with no contingencies, all cash, and no inspection contingencies.

It’s still a pretty crazy market.

Of course, the values have gone down a little bit, not every property is seeing that type of activity. And it also depends on the market and the area.

If you are interested in buying or selling, contact me.

Like “Majic” I’ll get it CLOSED!

(Maji) Maria Ramos Real Estate Advisor P.A

305-519-7940 | maji@majisold.com

Coldwell Banker Realty

• Miami Realtor since 1993

• 2nd Generation Realtor

• Expert Negotiator

• Market Trends Expert

• Miami native

• Bilingual – English & Spanish

• About me: https://linktr.ee/majisold

For the latest news on the Miami Real Estate Market please subscribe to my blog or YouTube channel:

~ Maji’s Market Minute Blog on MiamiHomeTrends.com http://bit.ly/

~ YouTube channel: https://bit.ly/

#majiramosrealestateadvisorpa #miami_home_trends #majismarketminute

#majisold #majipaceramos #miamirealtor #miamirealestate #miamirealestategent

#majiramos #Miamirealetstatemarket #homesellinginmiami #miamilistingagent #miamihomesforsale #miamicondosforsale #priceyourhouseright

#homevaluation #zillow #zestimate #homecalculator #whatsmyhomeworth #hasmyhomegonedowninvalue #miamihometrends #movingtomiami #miamineighborhoods

#googlemaji #housingmarket #contingencies

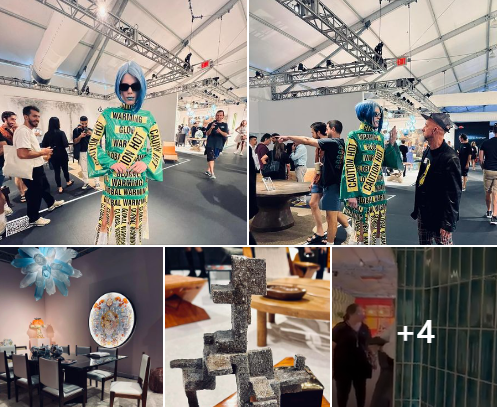

@BNI US National Conference. #2023bniusnc #bnibiscayneconnection #majismarketminute

Petrified Forest, AZ was so cool! Crazy to think we were walking in these ancient forests where dinosaurs roamed.

#petrifiedforest #googlemaji #majigreensustainablesolutions

Published by Maji Pace Ramos on May 1, 2023

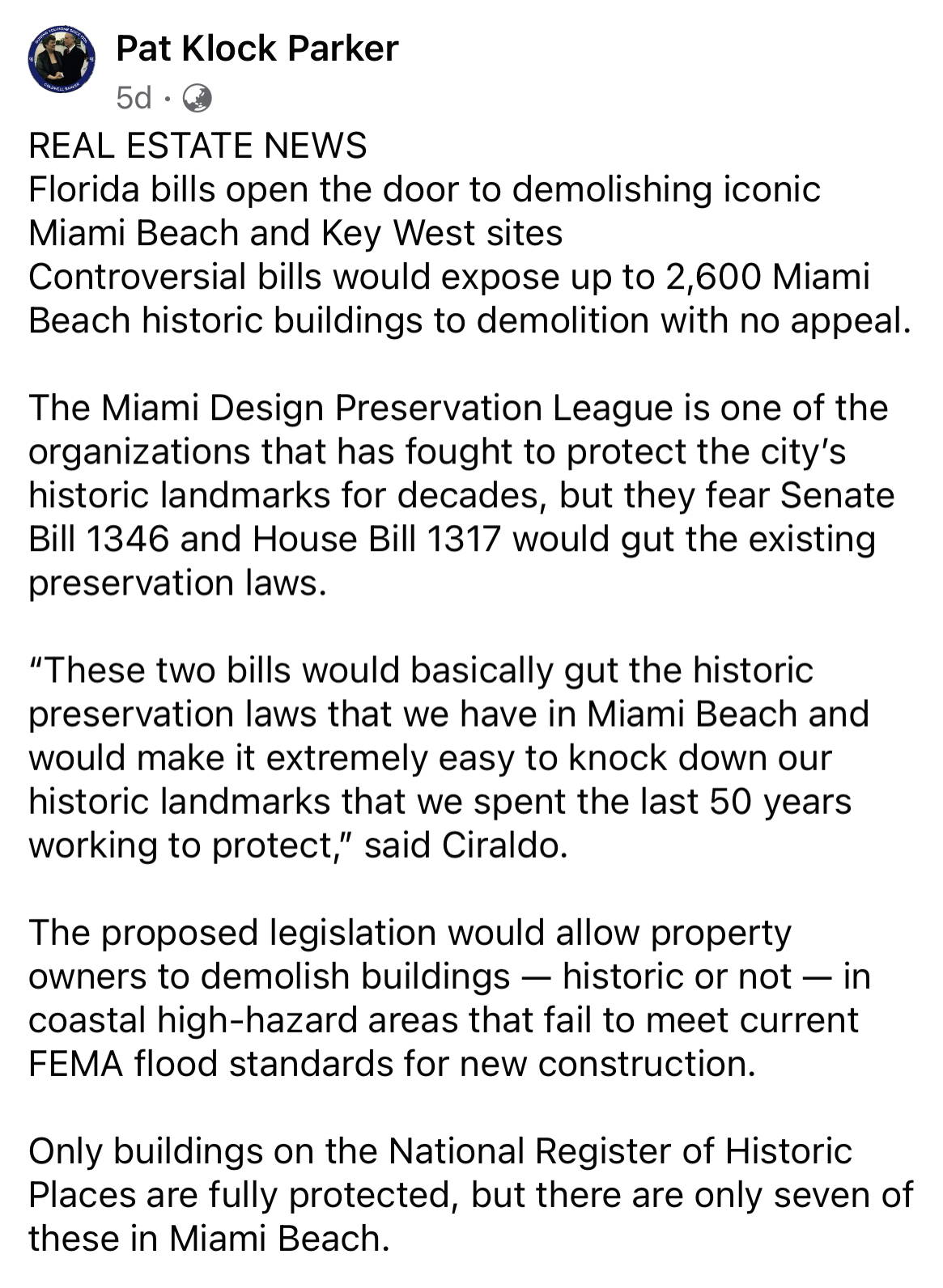

(via FB/Pat Klock Parker)

Published by Maji Pace Ramos on May 1, 2023

Published by Maji Pace Ramos on April 29, 2023

Published by Maji Pace Ramos on April 29, 2023

Published by Maji Pace Ramos on April 29, 2023

Published by Maji Pace Ramos on April 29, 2023

Published by Maji Pace Ramos on April 28, 2023

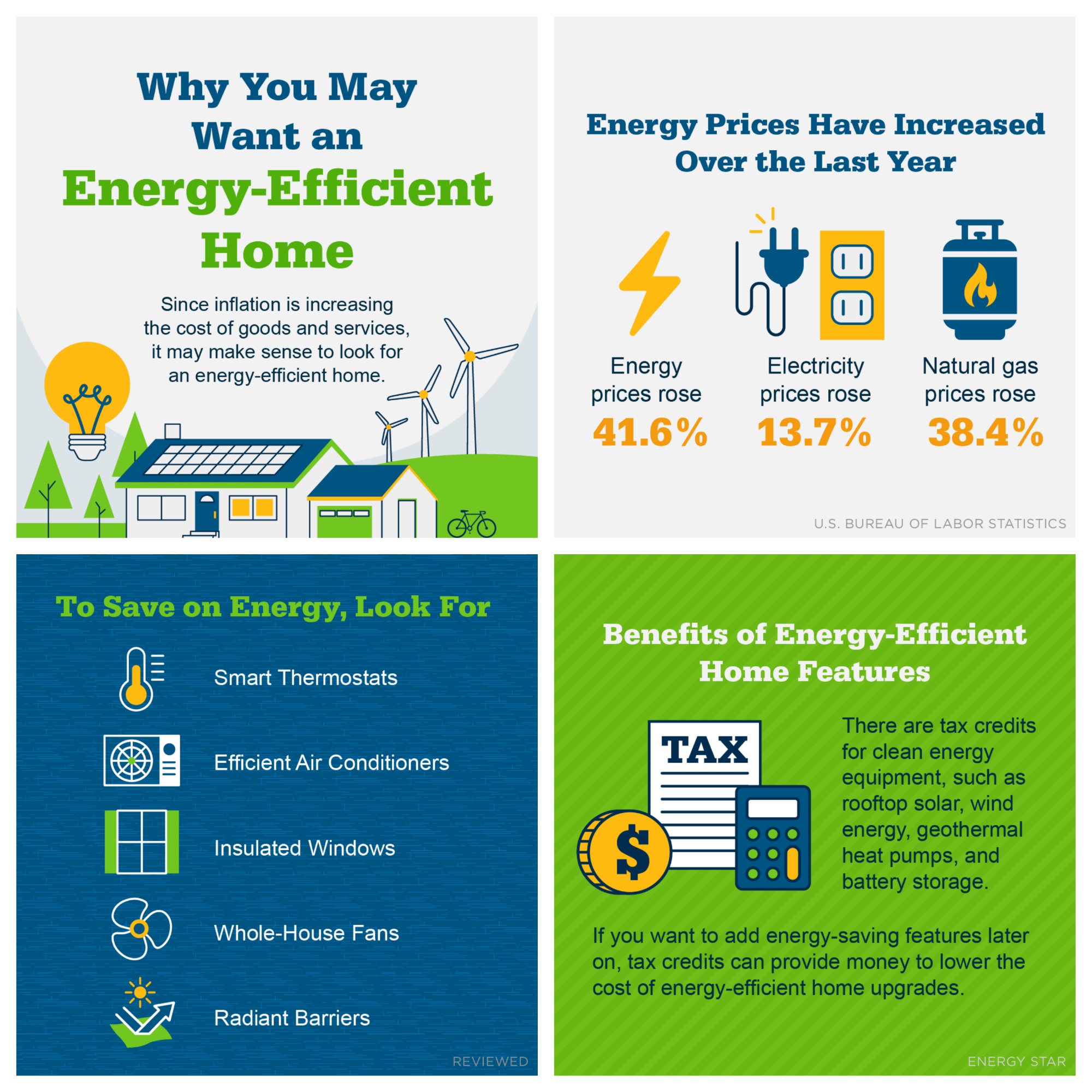

Since inflation is increasing the cost of goods and services, it may make sense to look for an energy-efficient home to help combat rising costs. DM me to learn about the options in our local market that could be what you’re looking for.

For more green tips please follow:

www.facebook.com/MajiGreenSustainableSolutions

Maji Ramos,

Maji Green-Sustainable Solutions

#itseasybeinggreen

#majigreensustainblesolutions #majigreen #googlemaji #majiramosrealestateadvisorpa #majiramosenvironmentalistrealtor #sustainablerealtor #majismarketminute #miamihometrends

#energyefficiency #greenhome #firsttimehomebuyer #opportunity #housingmarket #househunting #makememove #homegoals #houseshopping #housegoals #investmentproperty #downsizing #locationlocationlocation #keepingcurrentmatters

Published by Maji Pace Ramos on April 27, 2023

You’ve likely seen headlines about the number of foreclosures climbing in today’s housing market. That may leave you with a few questions, especially if you’re thinking about buying a house. Understanding what they really mean is mission-critical if you want to know the truth about what’s happening today.

According to a recent report from ATTOM, a property data provider, foreclosure filings are up 6% compared to the previous quarter and 22% since one year ago. As media headlines call attention to this increase, reporting on just the number could actually generate worry and may even make you think twice about buying a home for fear that prices could crash. The reality is, while increasing, the data shows a foreclosure crisis is not where the market is headed.